Chapter 12: Fiscal Capacity and Capital Improvement Plan

Purpose

Overview

Population Growth

Real Estate and Assessed Values

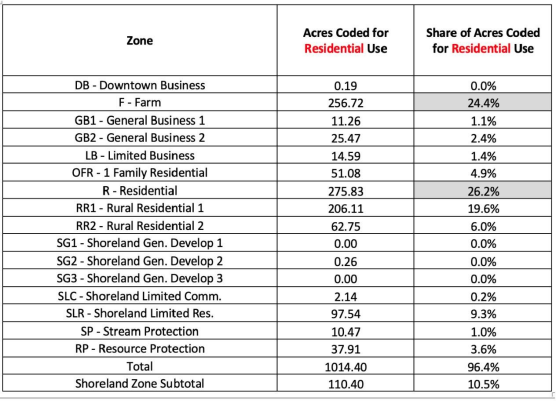

ASSESSMENT

$615,233, with and average value of $725,220. 60% of Town homes are vacant off-season, with owners headed elsewhere. The tax mil rate for 2023 was 6.32%—among the lowest in Maine—and tax revenues were $12,823,997. rentals mostly unused over each winter.

Municipal Budgets and Independent Financial Audits

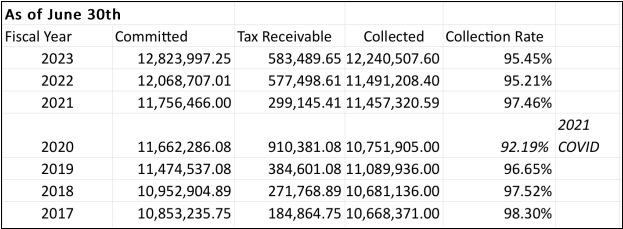

TAX COLLECTION

ANNUAL REVENUE AND EXPENSES

| 2019 | 2020 | 2021 | 2022 | 2023 |

Gov. Revenue | $4,478,683 | $4,337,794 | $5,743,802 | $4,534,233 | $4,835,566 |

Tax Collection | $10,751,905 | $10,751,905 | $11,457,320 | $11,491,208 | $12,240,507 |

Total | $15,230,588 | $15,089,699 | $17,201,122 | $16,025,441 | $17,076,073 |

Expenditures | $8,357,034 | $8,530,839 | $9,090,349 | $9,266,630 | $9,878,803 |

Transfers | $6,117,488 | $6,237,495 | $6,289,891 | $6,496,831 | $6,581,801 |

Total | $14,474,522 | $14,768,334 | $15,380,240 | 15,763,461 | $16,460,604 |

The Town is audited annually, and the results are posted on the Town website. The audit analysis provides three components: government-wide financial statement (which provide a broad view of the Town’s op- erations), fund financial statements (accounts segregated for specific purposes), and notes to those state- ments. The most recent published audit, conducted by RHR Smith & Company for the fiscal year 2022, found no instances of noncompliance with laws, regulations, contract and grant agreements which could have an effect on determination of compliance.

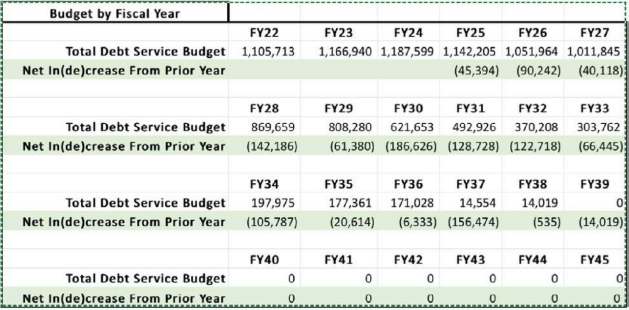

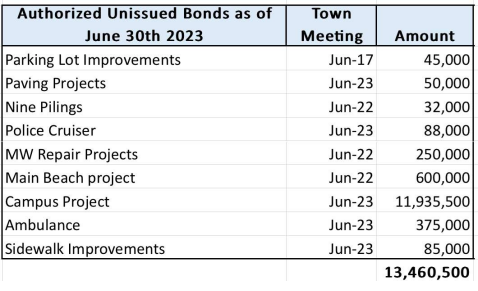

Capital Improvement Plan and Long-Term Financing Mechanisms

The Town has a Capital Asset policy dated 2002 and a Capital Improvement Planning pol- icy dated 2017, with a new policy recently re- leased. Ogunquit is updating all its financial policies in order to obtain a national rating by Standard and Poor and/or Moody’s for use in debt issuance for the recently approved mu- nicipal campus plan.

The Town’s Capital Improvement Plan includes a list of all capital improvements proposed in the next five fiscal years, some of which will be funded through indebtedness. The Town is also working to set aside reserves for acquisi- tion, repair, or maintenance of various capital items, such as vehicles and equipment.

The Town evaluates capital spending during each annual budget cycle, considering the im- pact on tax rates, the unassigned fund balance and debt service levels against operational and capital needs. Department Capital Budget re- quests must be renewed and prioritized every year. All Capital Budget requests are agreed by the Select Board before being submitted for voter approval. The Budget Review Committee collaborates and advises the Town, and its vote is shown on each warrant article. Each re-

quest is included on the annual Town Meeting warrant as a separate article with a description of financing and each must be approved by voters.

Ogunquit also has a State and Federal Funds Management Policy to provide guidelines for applying for and managing grants when available. Grants have been used recently to help fund storm damage repairs on the Marginal Way. Recent grants have been approved for replacing the Perkins Cove Footbridge as well as storm repairs to the Main Beach Parking Lot.

The Town participates in the Climate Ready Coast cohort of SMPDC to help plan a Regional Coastal Resili- ence Plan. Ogunquit also partners with its neighbors to develop a Southern Maine Energy Navigator Pilot to help roll out a home weatherization and electrification program, as well as working to develop and action plan to address stormwater runoff. Ogunquit and Wells police and fire departments work cooper- atively to minimize response times. In addition, Ogunquit has worked closely with the York Land Trust and Great Works Regional Land Trust to protect more forest and open space at the best costs for Town resi- dents.

Conclusion

Goals, Policies and Strategies

Goal

- To provide the most effective possible municipal government at the best possible cost.

Policies:

- Tofinance existing and future facilities and services in the most cost-effective

- Tocontinue to explore grants and gifts available to help fund capital investments within the

- Tocontinue to control Ogunquit’s tax burden.

Strategies:

- Priority: 1-5 with 1 being the highest priority.

| Description | Priority | Responsibility |

| Develop long-term capital improvement plan, identifying all known projects, with costs and timetables. | 1 | Town Manager |

| Assess the financial impact of sea level rise and corre- sponding reduced income from parking lots on taxes. | 2 | Town Treasurer |

| Explore opportunities to work with neighboring communi- ties to plan for and finance shared or adjacent capital im- provements to increase cost savings and efficiencies. | 3 | Town Treasurer |

| Continue to identify public/private funding opportunities. | 4 | Town Treasurer |

| Identify opportunities for municipal employees to develop revenue streams, especially for services to tourists. | 5 | Town Manager |