Chapter 8: Housing

Introduction

A comprehensive plan should contain a thorough analysis of a town’s housing trends. Critical issues include housing conditions, affordability, and estimated future housing needs. Specifically, this section aims to:

- Describethe existing conditions as they relate to Ogunquit’s housing stock in terms of the types and number of units that exist currently and how those units are occupied, with an eye to the seasonal use of much of the Town’s housing stock;

- Discusshousing affordability; and

- Presentan estimate of future housing needs based on population

Housing Overview

This section is an overview of the current housing situation in Ogunquit and attempts to place the Town’s housing issues in a regional context. In developing this housing inventory, data was drawn from the U.S. Decennial Census, the U.S. Census American Community Survey (ACS), Town records, and MaineHousing, the State housing authority.

Existing Housing Stock

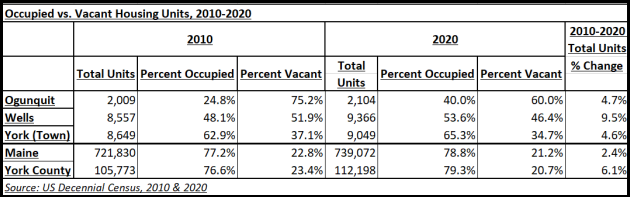

Housing Vacancy and Seasonal Housing

Housing Unit Growth

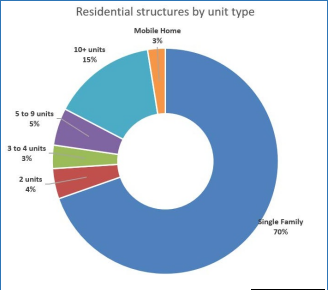

Housing Unit Types

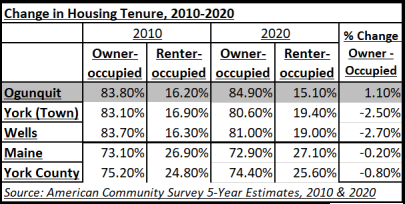

Housing by Tenure (Leased vs Owned Housing)

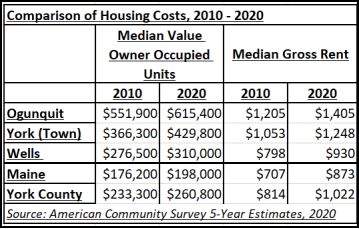

Housing Costs Analysis

Housing Conditions

Housing Affordability

Affordable housing is a concern for all communities in the region. While even middle-income households are affected by the high cost of housing, it is a particular problem for low-income households.

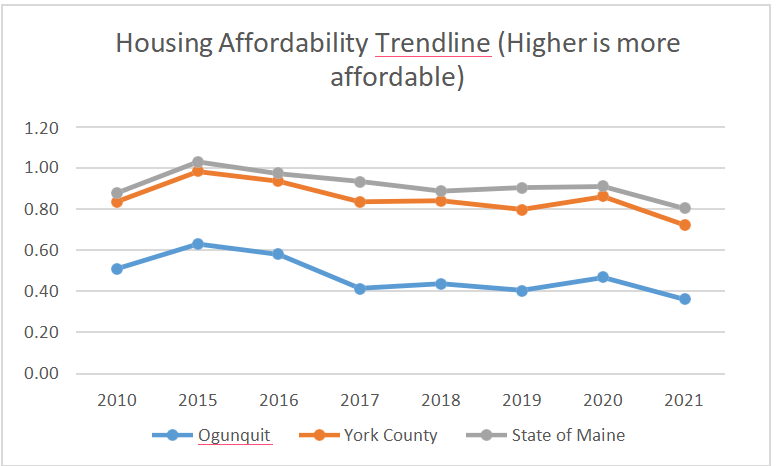

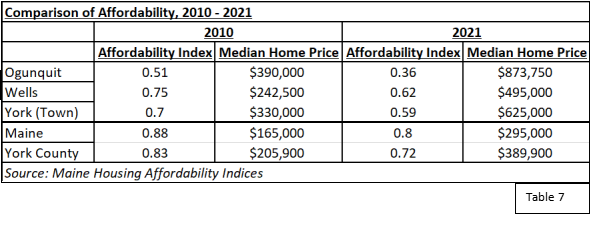

The Affordability Index is a MaineHousing statistic that is produced annually. It is the ratio of the Median Home Price to the Home Price Affordable to the Median Income. The affordable home price is one where a household making the median income could cover a 30-year mortgage, taxes, and insurance with no more than 28% of their gross income.

- Anindex of 1 indicates that the home price is affordable to the median

- Anindex of less than 1 indicates that the home price is generally

- Anindex of greater than 1 indicates that the home price is generally

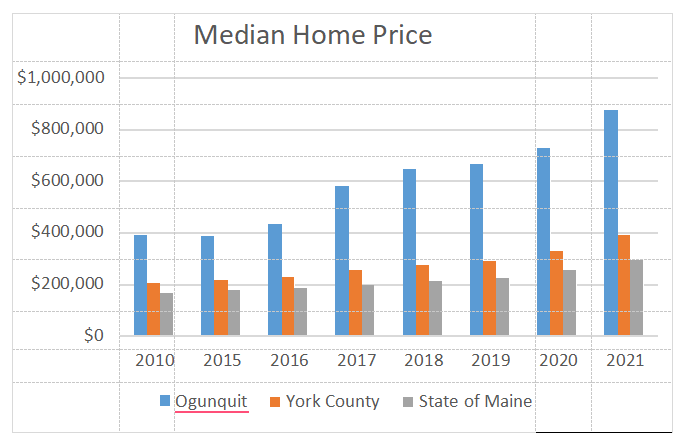

As shown in the following charts (Figure 7 and 8), Ogunquit has been significantly less affordable than the State and county averages throughout the period shown. With the exception of a brief drop in the median home price between 2010 and 2015, a time period that overlaps with the Great Recession, each of the last 10 years has seen an increase in the median home price, which as of 2021 stood at $873,750.

- Moderateincome households are those earning between 80% and 120% of the area median

- Low-incomehouseholds are those earning between 50% and 80% of the area median income

- Verylow-income households are those earning less than 50% of the area median

| York County Area Median Income (AMI), 2023 | ||||

| AMI for a 4-person household | 20% of AMI | 50% of AMI | 80% of AMI | 120% of AMI |

| $91,700 | $18,340 | $45,850 | $73,360 | $110,040 |

| Source: US Department of Housing and Urban Development, 2023 | ||||

Housing Demand Projections

| Housing Demand Projections, 2020 through 2040 | ||||

| 2020 | 2030 (Projected) | 2040 (Projected) | Change 2020-2040 | |

| (Actual) | ||||

| Population Change | Additional Population | |||

| 12.6% Population Growth Scenario | 1,577 | 1,694 | 1,775 | 198 |

| 25.3% Population Growth Scenario | 1,577 | 1,971 | 2,464 | 887 |

| Total Occupied Housing Units (Assuming Household Size Stays Same) | Additional Units Needed | |||

| Average Household Size (Calculated) | 1.91 | 1.91 | 1.91 | – |

| 12.6% Population Growth Scenario | 709* | 799 | 900 | 193 |

| 25.3% Population Growth Scenario | 709* | 889 | 1,114 | 343 |

Ogunquit Zoning Ordinance

New Legislation and Housing Implications

In 2022, the State of Maine legislature passed several pieces of legislation aimed at increasing housing stock in Maine, primarily through zoning regulations. The most significant law H.P. 1489

- D.2003 “An Act to Increase Housing Affordability through Zoning and Land Use” enacted a set of zoning requirements that require municipalities to allow higher density housing in various ways throughout the community. Higher density allowances are required in areas that are

identified growth areas or are equipped with public sewer and water infrastructure. There are three major components to the law:

- Developmentsin identified growth areas or areas serviced by public water or sewer must be allowed density 2 ½ times the base zone density if most of the housing units meet defined standard affordability requirements for a minimum of 30

- Anywhere housing is allowed, municipalities must allow at least 2 units per lot on vacant In areas of identified growth areas or areas serviced by public water or sewer, up to 4 units must be allowed on vacant lots. On lots with an existing single-family dwelling, municipalities must allow the addition of up to two units.

- On any lot with an existing single-family dwelling, municipalities must allow the additionof at least one accessory dwelling unit.

The State requirements take effect in July of 2024; an LD 2003-compliant zoning Ordinance was brought to a vote at Town Meeting in June 2023 but did not pass. A revised Ordinance is currently under review, with plans for a vote again in June of 2024.

Conclusion

Goals, Policies and Strategies

Goal

- Tofacilitate the creation of a range of quality affordable housing to meet the needs of residents.

Policies:

- Maintain,enact, or amend growth area land use regulations to increase density, decrease lot size, setbacks, and road widths, or provide incentives such as density bonuses, to encourage the development of quality affordable/workforce

- Maintain, enact, or amend Ordinances to allow the addition of at least one accessoryapartment per dwelling unit in growth areas, subject to site

- Create or continue to support a community affordable/workforce housing committeeand/or regional housing coalition.

- Developpolicies and strategies to address Aging in

Strategies:

- Priority: 1-5 with 1 being the highest priority.

| Description | Priority | Responsibility |

| Create an Affordable/Workforce/Senior Housing Committee. | 1 | Select Board |

| Modify zoning Ordinance to require 15% of units in new multi-unit residential development over the next 10 years to be affordable. | 2 | Planning Board |

| Work with/establish local and/or regional housing coalitions in addressing affordable and workplace housing needs. | 3 | Housing Committee |

| Analyze and make recommendations on the feasibility of incentivizing the development of affordable housing, particularly in growth areas. | 4 | Select Board |

| Maintain, enact or amend growth area land use regulations to increase density, decrease lot size, setbacks and road widths, or provide incentives such as density bonuses, to encourage the development of affordable/workforce housing. | 5 | Planning Board |

| Re-invigorate the Age Friendly Community Committee. | Select Board | |

| Analyze and make recommendations on the feasibility of public/private development of affordable, workforce and senior housing. | Housing Committee | |

| Analyze and make recommendations on restricting short term rentals to specific zones. | Planning Board | |

| Work with the State to install sound barriers along I-95 near residential neighborhoods. | Town Manager | |

| Review cable/Wi-Fi providers and evaluate opportunities for future fiber optics. | Town Manager | |

| Seek to achieve a level of at least 15% of new residential development built or placed during the next decade be affordable. | Planning Board | |

| Designate a location in growth areas where mobile home parks are allowed and where manufactured housing is allowed pursuant to applicable State law. | Planning Board | |

| Strongly encourage the use of heat pumps and other green initiatives. | Sustainability Committee | |

| Analyze and make recommendations as to the feasibility and desirability of revising Town Ordinances to restrict the size of residential subdivisions. | Planning Board | |

| Analyze and make recommendations on the feasibility of assessing impact fees on short term rentals. | Select Board | |

| Work with local affordable housing coalitions to attract affordable development in the Town. | Town Manager |